How does continuing to work while collecting Social Security benefits affect how much Social Security you will receive? And what is the difference between “normal Social Security retirement age” and “full Social Security retirement age” and “delayed Social Security retirement age”? And why does the Federal government have to make senior benefits like Medicare and Social Security seem so freaking complicated when it’s actually pretty straight-forward?

Well, much like I have done with my Medicare explained in plain English and my Medicaid for the elderly explained in plain English, I’m going to explain in plain English how still working and earning while collecting Social Security impacts your Social Security benefits and how much you receive, as well as how your choice of when you start collecting your Social Security benefits impacts how much you receive.

NOTE: This articles deals only with regular monthly Social Security payments to the original wage earner, not spouse or survivor benefits. In other words only to your collecting your Social Security benefits based on your earnings that you earned yourself over the course of your life. Also, this article has simplified some things which may actually be a little more complex, such as how the Social Security Administration calculates paying back withheld benefits. However, it does explain in plain English enough to get you to a place where you understand your options, which is my goal in writing it.

How Your Age When You Start Getting Social Security Affects the Amount You Will Receive

We’re starting with the age part of the equation because it’s the most straight-forward (although how continuing to work affects how much Social Security you will collect is really only slightly less straight-forward).

The reason it seems so complicated is that there are three different age events which impact how much you will receive and which, in fact, will lock in how much you receive for the rest of your life. The bottom line here is that the longer that you delay collecting Social Security the higher will be your benefits once you do start collecting them.

Age Event #1: Turning 62

You are entitled to start collecting Social Security payments when you turn 62. However this will lock in the very lowest monthly payment, forever.

Age Event #2: Reaching “Normal or Full Retirement Age”

This is where the Federal government starts the torturing of senior citizens by confusingly using two different terms for the exact same thing! And then adding acronyms to boot. So let’s get this straight right now:

For the purposes of collecting Social Security “full retirement age” (also referred to as ‘FRA’) and “normal retirement age” (also referred to as ‘NRA’) are the exact same thing. They are just 4 – count ’em, 4 – different terms which all mean “the age at which you are entitled to collect your full Social Security benefits”. (Except it really isn’t, at least not for the regular definition of “full”, as you can still collect even more, which we’ll get to in a minute, and that’s why for the rest of this article we will use the term “normal retirement age” for age event #2).

Most people think of normal retirement age as being 65, but for purposes of Social Security normal retirement age is 66, plus a certain number of months (how many months depends on when you were born), unless you were born in 1960 or later, in which case your normal retirement age is 67. At least it’s 67 as of the time of this writing (this is being written in April of 2023).

Here’s how it breaks down:

If you were born in or before 1954, your normal retirement age is 66.

If you were born in 1955 your normal retirement age is 66 plus 2 months.

If you were born in 1956 your normal retirement age is 66 plus 4 months.

If you were born in 1957 your normal retirement age is 66 plus 6 months.

If you were born in 1958 your normal retirement age is 66 plus 8 months.

If you were born in 1959 your normal retirement age is 66 plus 10 months.

If you were born in 1960 or after your normal retirement age is 67.

(Source: ssa.gov)

If you elect to start collecting Social Security when you reach your normal retirement age you will lock in the ‘normal retirement age’ amount for the rest of your life.

Age Event #3: Turning 70 also known as “Delayed Retirement”

If you choose not to start collecting Social Security when you reach your ‘normal retirement age’ of 66+, and put it off completely until you turn 70, you will collect an amount greater (sometimes far greater) than the ‘normal retirement’ amount. Turning 70 is the last age event that impacts how much you will receive every month for your Social Security benefits, and is known as “delayed retirement”. Turning 70 locks in the highest amount possible.

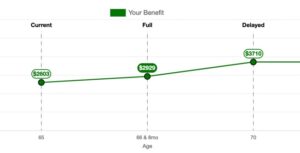

As an example, in the chart below, taken from someone’s actual Social Security account, if this person started collecting Social Security at their ‘normal retirement age’ of 66 and 8 months, they would collect $2929 per month. However, if they wait another 3 years and 4 months, when they will turn 70, they will collect $3710 per month. While we can’t see what they would have collected at age 62, we can see that at age 65 they would collect $2603 per month.

So at What Age Should You Start Collecting Social Security Benefits?

While simply waiting until age 70, if you can, may seem like a no-brainer, it’s not quite that simple. You have to make an educated guess as to how long you plan to be around. If you think that you will live well past 70, and if you can afford to wait, it may make sense for you to wait until you are 70 to start collecting Social Security. On the other hand, if you really need the money sooner, or if your life expectancy is limited, it may make more sense to collect sooner.

And that’s even before we get to whether you want to or need to continue working and earning income while you are collecting Social Security.

How Continuing to Work Affects How Much Social Security You’ll Get

The second thing that the Federal government makes oh-so-confusing is how your Social Security benefits (i.e. the amount you’ll receive) are affected if you continue to work (in other words continue to earn an income) while receiving Social Security. In fact, they make it crazy confusing, explaining it in many different ways, sometimes even on the same page.

They Say “Deduction”, We Say “Penalty”

How much you will be penalized (and let’s face it, no matter that the Social Security Administration calls it a “deduction” from your Social Security benefits, it’s actually a penalty for those who choose to or need to keep on working) depends on how much you earn and also on whether or not you have reached your ‘normal retirement age’ (aren’t you glad we explained normal retirement age first?) This is true regardless of whether the income is paid to you by someone else (i.e. wages) or through self-employment.

Now, while we call it a penalty, it isn’t a true penalty in as much as eventually you get it back. So maybe we should really call it “the Federal government ‘borrowing’ money from you which they will pay back eventually. Without interest.” As the AARP explains, “What Social Security does instead is increase your benefit when you reach full retirement age to account for the previous withholding.”

Call it a ‘withholding’, call it a ‘deduction’, call it a ‘penalty’, whatever you call it, it’s money that is yours which you aren’t receiving, nor getting interest on when you get it back, even though you could be earning interest on it if it weren’t being made unavailable to you.

The Good News

Here’s the good news: once you reach your normal retirement age (i.e. 66 plus some number of months unless you were born before 1954 (then it’s 66) or in 1960 or after (then it’s 67)) then you can work as much as you want, and earn as much as you want, and it will not impact your Social Security payments at all; you will still get the full amount of Social Security. So the deductions that penalize you for working while collecting Social Security are only for those who continue to work or otherwise earn an income and who are below age 66.

The Bad News

The bad news is that if you are also working and otherwise earning additional income, there is a good chance that you will have to pay income tax on a portion (up to 85%) of your Social Security along with your other income. Yes, the Feds giveth and the Feds taketh away.

The Annual Earnings Test

The first thing that you need to know about the ‘Annual Earnings Test’ (or “AET”, because they have to acronymize everything) is that it’s not really a test. It’s a calculation, and is used to calculate how much of your Social Security you are not going to receive if you have not yet attained ‘normal retirement age’ (i.e. are under age 66ish), and you continue to work while receiving regular Social Security.

The second thing that you need to know is that even though you get monthly payments from the Social Security Administration, the Social Security Administration (“SSA”) actually does almost everything (such as calculations, withholdings, etc.) based on annual amounts. So, for example, if you are getting monthly Social Security payments of $1000 a month, the Social Security Administration actually considers and calls that “$12,000 a year” – they just send it to you in nice monthly chunks.

The third thing that you need to know is that there is a difference between collecting Social Security while also working during years in which you will be below your ‘normal retirement age’ for the entire year, and collecting Social Security while also working during the year in which you will attain your ‘normal retirement age’. This is because once you attain your ‘normal retirement age’ you will no longer be penalized.

How the Annual Earnings Test Works

If You Will Not Reach Your ‘Normal Retirement Age’ During the Year

If you have not yet reached your ‘normal retirement age’, and will not reach your ‘normal retirement age’ during the current year, and you choose to start receiving Social Security benefits and you are still earning an income, you are allowed to earn (in 2023) $21,240 from your job before you start getting penalized. For every $2 you earn above $21,240 you will be penalized $1 out of your annual Social Security amount. This is based on what you earn annually, which you will report to the Social Security Administration.

Example: You earn $22,240 in 2023, which is $1000 above the “won’t get penalized” earnings limit. For every $2 you have earned that is above the limit your annual Social Security benefits will be reduced by $1, so in other words in this example you will have $500 ($1 for every $2 that you earned over the limit) deducted from your total annual Social Security payments.

Important: They don’t amortize it across your monthly payments; they stop sending you payments at all until the withholding of $1 for every $2 that you earned over the limit is satisfied.

If You Will Reach Your ‘Normal Retirement Age’ During the Current Year

If you are going to reach your ‘normal retirement age’ during the current year, then two things change:

1. The amount you are allowed to earn before you penalized with money being deducted from your Social Security payments goes up substantially (to $56,520 for 2023; that’s quite a jump from $21,240); and

2. Instead of you being penalized $1 for every $2 you earn over the limit, you are penalized $1 for every $3 you earn over the limit.

In addition, as soon as you reach your ‘normal retirement age’ the penalty ceases and you start getting the full amount of Social Security, plus a repayment added to your monthly benefit to account for the money they took because you were earning over the limit while you were below the ‘normal retirement age’.

Finally

As a reminder, this article has simplified some things which may actually be a little more complex, such as how the Social Security Administration calculates paying back withheld benefits. However, it does explain in plain English enough to get you to a place where you understand your options, which is my goal in writing it.

To check on what your benefits are or will be, and to sign up for Social Security to start accessing your benefits, go to ssa.gov/onlineservices

Recent Comments